For the last 40 years, Republican policies have shifted the majority of this country’s wealth away from working families and pushed it up to the rich. The GOP agenda of cutting taxes for corporations and the super-wealthy — continued by Donald Trump — has left us with historic levels of inequality. The richest 1% now hold 32% of American wealth. Meanwhile, 40% of Americans would have trouble meeting an unexpected $400 expense.

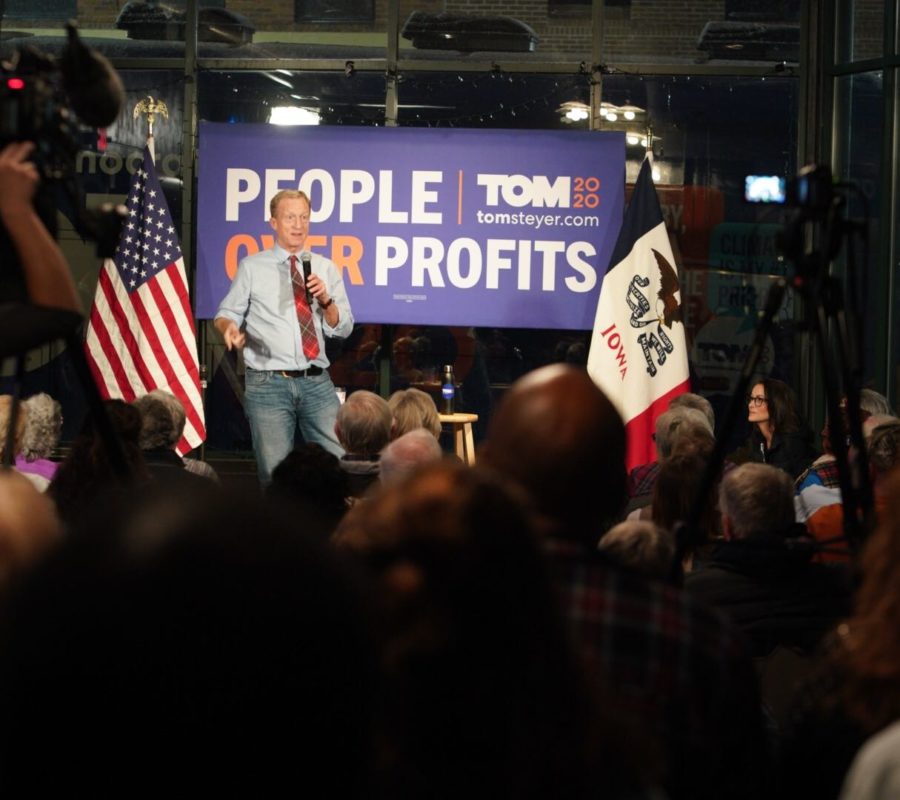

This is a sustained, calculated attack on the American worker. An economy that forces millions of people to work multiple jobs — who still struggle to save or afford health care — is an economy that’s broken. Despite this, Trump will continue to campaign on his economic strength, and in order to beat him in November, Democrats need a nominee who can expose him as a complete failure. Tom grew his small investment firm into a multibillion-dollar business and has the experience needed to go toe-to-toe with Trump on the economy.

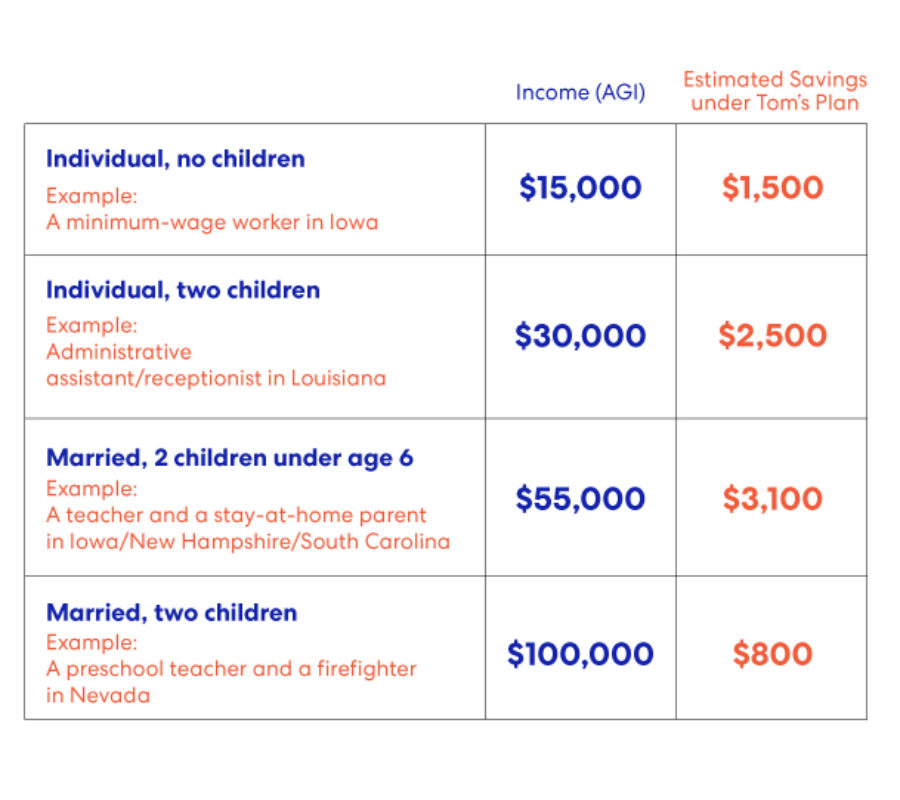

As president, Tom will build a people-powered economy that harnesses American innovation and ingenuity. A Steyer administration will revitalize the middle class by providing tax relief to working families, making strategic investments for sustained growth, creating millions of new jobs, and opening the doors of economic opportunity once again.